Anyone who has spent time working in the financial sector will know that if there’s one thing synonymous with the role, its paperwork. Many businesses and operations still deal with physical records, which means a lot of documentation to take care of. Managing that paperwork can be tough, but a document scanner can help your business digitise that process for easier management and storage.

Through digitisation, you can store, order and recall financial documents with ease. You’ll also be supercharging your efficiency – now able to send documents digitally rather than posting mounds of physical paperwork between offices.

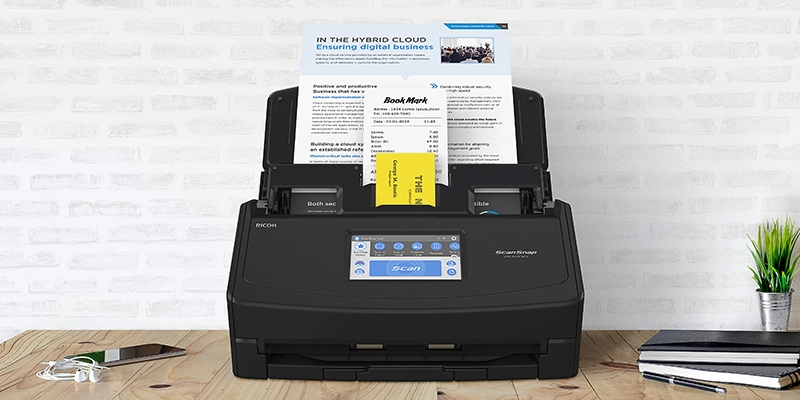

ScanSnap scanner can help you digitise and modernise your document handling operation. All you need to do is scan a document – it’s as quick and easy as that.

Ready to learn more about ScanSnap?

Read on to find out how ScanSnap document scanner can help your financial services firm.

What are the 5 key advantages of financial document digitalisation?

ScanSnap allows for super-simple scanning and document conversion. That makes the process a whole lot easier for you and your customers. Discover some other ways document scanning make your operation more efficient and safer for your customers.

1. Storing files with greater security

Physical paperwork can get lost or damaged. That’s the last thing you need to happen to essential financial records. All that paperwork needs storing too, which means hefty storage units and filing cabinets taking up valuable office space.

Physical paperwork can get lost or damaged. That’s the last thing you need to happen to essential financial records. All that paperwork needs storing too, which means hefty storage units and filing cabinets taking up valuable office space.

Scanning documents into your computer means you can store near-infinite documents safely and securely on your server. All without the need for clunky cupboards and cabinets.

Digital documents can be shared with the relevant parties quickly and easily. Plus, you can password-protect your files to ensure they don’t get into the wrong hands.

Greater security is sure to reflect well in your customer trust levels. And, in ever-evolving financial regulations, you’ll be staying on the right side of data protection laws and compliance.

Of course, there’s no chance of spilling coffee on a PDF either.

2. Maximising efficiency

Streamline your onboarding and customer communication process by digitising your document process. By scanning in financial records, you can immediately access and recall documents whenever you need. Gone are the days of posting hefty parcels of paperwork and hoping they arrive on time.

Not only does immediate access improve your efficiency, but you’re in full control of the document at all stages of delivery and receipt. Plus, there’re no postage bills either.

3. Boosting collaboration and document-sharing

Hybrid working and splitting your working hours between the office and home, rose out of necessity during the COVID-19 pandemic. With the world now open once again, the trend has remained popular. Indeed, 84% of pandemic-induced homeworkers planned to continue doing so.

Hybrid working and splitting your working hours between the office and home, rose out of necessity during the COVID-19 pandemic. With the world now open once again, the trend has remained popular. Indeed, 84% of pandemic-induced homeworkers planned to continue doing so.

Having clients and colleagues out-of-office can pose a problem when it comes to sharing physical documents.

Digitised paperwork can be shared wirelessly in just a few clicks. Whether you’re using email, a file sharing site or have cloud-based data storage, all your team can access that right documents wherever they are.

4. Organising files more accurately

One plus of digitisation is the ability to edit and alter documents as you go. By treating a file as ‘live’ you can make sure you keep the data held within accurate and up to date.

Editing documents digitally is cleaner, clearer and more easily shared than making physical amends to paper records.

Plus, you can use a document scanner to convert your scans into a variety of different file types. This means you can access them across a range of operating systems and services – sharing them with clients and colleagues easily no matter what equipment they’re using.

5. Saving on storage space and time

Any financial services firm will know that some contracts come with mountains of paperwork. Storing all those files and sheets takes up a lot of space. Valuable office floorspace, in fact.

Any financial services firm will know that some contracts come with mountains of paperwork. Storing all those files and sheets takes up a lot of space. Valuable office floorspace, in fact.

Through digitisation, you can store almost infinite files on hard drives, or in cloud storage. That does away with the need to store paper documents in cabinets, freeing up office space to expand your operation or create a better working environment for your current team.

Besides, digital files are easier to manage too. You can find and recall specific document with a simple search, rather than manually leafing through stacks of paperwork in a drawer.